Always know where the fire exit is.

Today’s Sunday Column asks where in 2024 the exits are for sports investing, and how quick one can get to the door if needed, and if any of us are getting out of here alive.

The Albachiara Journal is an eclectic collection of our opinion and perspective, from our travels and encounters.

This Column closely reflects the sector upon which it opines. It thus needs to move erratically in its commentary each week, from romantic philosophy to callous pragmatism.

In a week when the discord around the “tyranny of the majority” in the English Premier League (EPL) really starts to show all its bad blood, we are today obliged to tend towards the latter.

The Manchester City legal case was never going to end well.

We are now, indeed, nearing “the end”.

Perhaps of the EPL itself.

Pessimism may be unattractive, and whilst it is always inspiring to hope for the best, it’s better to prepare for the worst. So, in corporate finance, like sport, over-sentimentality is never recommended. Assets need to be exited when the moment comes. And quickly.

Don’t ever let yourself get attached to anything.

Something you can walk away from in 30secs.

In the best action films, the hero will always know where his/her exits are located, well before it all starts going down. In finance, that same thing is called understanding liquidity.

Can you sell? How quickly?

For anyone involved in advising people deploying capital in sport assets and sportech, this is the only question to start the conversation today.

What do you think your exit will be?

Forget valuation, due diligence, benchmarking. Forget all that for a moment. The focus today needs to be on the eventual exit. And will you be able to get out alive?

SIMPLE MINDS – Book Of Brilliant Things LIVE Ahoy 1985

P.S. Kerr, at minute 4, shows why in 1985 they were in the conversation as biggest band in the world. This Morrison quote is totally improvised, and it’s not in the official lyrics of the song. And he is the personification of “rock star”.

So today’s Sunday Column asks where, in 2024, one will find the exits for sports investing, and how long it will take to get to the door, if needed. But more basically, if any of us are even getting out of here alive.

For anybody working closely with early-stage companies serving sport, they will know that this is not overly-dramatic. We are in a brutal bear market.

Extraction points.

In the world of finance theory, you can get an exit, hopefully with return, in different ways.

Your asset generates a lifetime of reliable dividends (yield) that represent in itself an “exit”.

You list on a stock market. That’s called an Inital Public Offering (IPO).

You take capital from a Private equity (PE) fund.

You get a venture capital (VC) to fund your losses well into a future, before the ultimate exit.

You achieve a trade sale, selling your company to a bigger operator.

Which of these exits are realistically within our grasp today?

Where is our phone booth?

Taking these in turn…

1. Dividends are no longer certain, when revenue models are now so volatile.

There is no business in this world of intense disruption that can rely on the stability of future dividend flows. Too much is going to change.

Sport, especially in Europe, doesn’t even make a lot of profits from which to pay dividends; football and rugby being the best examples. Ancillary businesses are not really super-profitable across the board; the content/media model is challenged, and sportech has focussed more on growth than margin. Additionally, suppliers to sport don’t have much pricing power, selling into rights holders. Nothing at all is throwing off cash.

So, best to exclude dividends as your off-ramp.

2. IPOs as an exit route, as a means to a liquidity event, are now as scarce as a Marcus Rashford‘s performance.

Here we see the sad sad situation, and it’s getting more and more absurd.

IPOs, a public stock market listing, used to be the most well-trodden path, but that world is long gone. The private version of equity, PE, has steamrolled the IPO game in the last decade. For the few sport IPOs that still remain, they all tend to disappoint, especially when investors look beyond the sexy stardust, and realise that it’s a sector really poorly managed, and with bad leadership. Have a look at the share price graph of all categories of listed sports assets, from various SPACs, Genius, Radar.

Hype only goes so far, especially when market sentiment changes, and perfect storms gather.

3. PE can’t continue with its current model if it itself can’t find exits.

The muddled thinking and travails of the PE model, especially in sport, have been a long-standing punchbag for this Column and Goal Own Goal. But that pessimism has been more than prescient.Perhaps, even understated.

In fact, one worries that we haven’t yet seen the worst of the malinvestment fallout, as mark-to-market valuations are being delayed as long as possible, especially with the use of our old friend theContinuation fund.

The facts show that PE funds can’t find an exit, a phone booth, and they will need to hide the reality of their underperforming portfolio assets. But for how long?

4. VC and the Silicon Valley Playbook have totally changed.

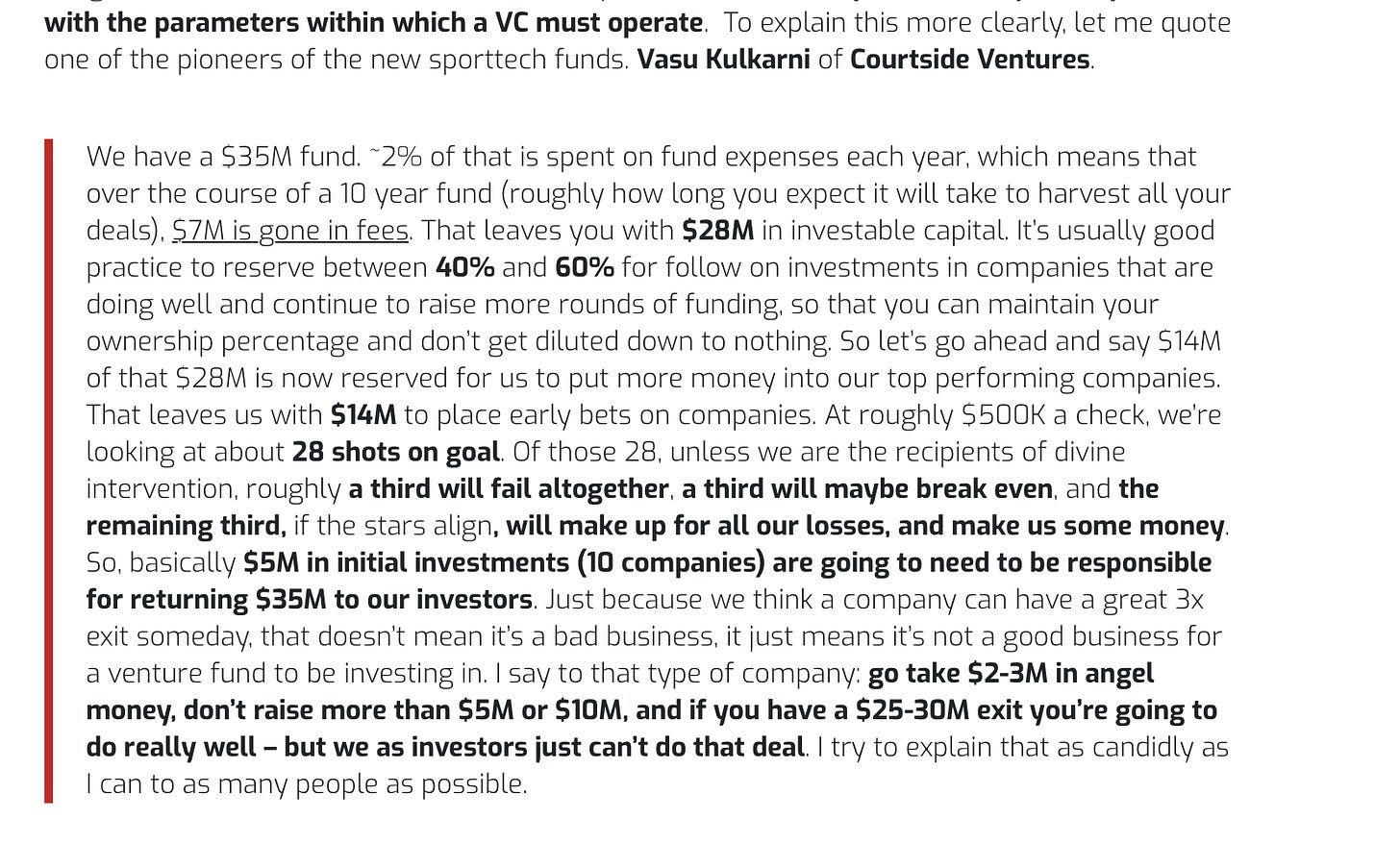

One of the very first Columns in 2018 pointed out how little sport was ready to understand the MO, and fickleness, of VC. How the whole game worked. Back in 2018, Vasu Kulkarni from Courtside, explained its reality beautifully, and this exact passage inspired an entire chapter of the book “Sport’s Perfect Storm“.

For four years of the sportech bull market, understanding how VC really worked, with all its inherent risk in bear markets, didn’t matter. There was always fresh cheap capital.

Then, it changed. Oops!

So, it was very cool this week to see the same Courtside Ventures (one of the first sport VCs) do an honest post-mortem on their own journey in these years.

This is golden insight, for which they should be commended. If you take your time to analyse well the activity of their three funds, you will see that they seem to have had only two true successful exits out of seventy one investments. The positive return they are claiming on these funds comes from un-exited companies they still hold.

Let’s be very honest, VCs are great in optimistic good times, but too many have confused their own brilliance with the simple good timing of a macro bull market. Exits, successful ones, are rare these days, and valuations will be uncertain. One is tempted to comment…

Let’s speak again Vasu, and do the real sums, once you actually get out of your portfolio companies.

5. That leaves trade sales. Getting out alive by finding someone else to buy you.

YouTube to Google, WhatsApp to Facebook. Et al.

The sport industry has a new sexy case study about which to get optimistic.

Dorna (MotoGP) selling to Liberty F1. What kind of exit was that and what does it tell us?

If trade sale exits are where we need to concentrate, it would be smart to study this deal very well, and this is the public domain document produced for the transaction. It is very informative.

The deal values Dorna at an equity value of €3.5bn. Liberty are buying 86% of the equity (65% in cash, 21% in swapping Liberty F1 listed stock ticker FWONK). So, it’s mainly a cash exit and that’s a big win in these risky markets. For the record, the Liberty shares themself look to me very fully valued at their current share price.

Take the cash. That is real exit liquidity at an excellent valuation. It doesn’t get any better than that these days.

As a “trade-sale” what is this exit telling us about the market in this industry?

Dorna has revenues of €486m of which 43% is media rights and 17% sponsorship. The Liberty PR talks about the merger “benefitting from tailwinds in sports media rights and sponsorship”.

No comment, aside from noting in the margins that the complacency of this entire sector seems to remain strong.

Dorna makes adjusted EBITDA of €179m. Their own document of course shows the usual Charlie Munger “bullshit” EBITDA earnings number.

Dorna actually made a real consolidated LOSS of €38, €8m, €28m in 2021, ’22, ’23, respectively. Closer scrutiny reveals, for example, a very large depreciation figure of £150m. You will want to ask what that is, if you are a pro.

Charlie (Munger that is 😉) is no longer with us, but the best respect you could ever show him would be to look at any future EBITDA number with total scepticism, and find the page in the official accounts that shows the reconciliation between EBITDA and real net profit/(loss).

Here it is for Dorna.

So, the Dorna equity in the deal is valued at 7.2x revenues, and near to 20x EBITDA profits. Put in the context of more normal markets, a prudent financier could say that they are paying €3.5bn for a business that is breakeven at best, and where they are vastly over-optimistic on future media values.

This Column isn’t going to be in judgement of the quality of deal that Liberty has done.

There is no right or wrong in valuation, especially in times of market turbulence. One could talk synergies and up-selling all day to justify the price. Suffice to say, there is an argument that it is a very chunky valuation for a company with flat revenues, and over-optimism on the idea of growth in media rights. The best argument for MotoGP is geographical expansion. It has always been (since the time Raffaella was sponsoring Max Biaggi at Marlboro), a two-market business. Spain and Italy.

Personally, I would not have done the deal at that price. Conversely, as the seller, I would have “bitten their hand off”, especially as most of it is cash. That’s a gift and a real exit. Assuming there is no lock-in preventing them selling the Liberty F1 stock, the old Dorna shareholders will have “gotten out of here alive”. Big time.

For some reason, I’m reminded of an unrelated tweet my son sent me this week.

“Zimbello” would translate well for a finance audience as “Greater Fool”.

The Greater Fool theory argues that prices go up, because people are able to sell overpriced securities to a “greater fool”, Whether or not, they are overvalued. That is, of course, until there are no greater fools left. – Investopedia.

Whatever.

Making money in sport investing is full of opportunities. Reasons to be cheerful everywhere. You just need to ask the right question out the gate…

What is the expected exit?

To continue reading this article, and discover the expected exit, please click here.

Embark on a gripping journey through the intertwined worlds of sports, media, and finance in "Sport's Perfect Storm."

Authored by Roger Mitchell, this illuminating book unveils the challenges these industries face amidst a hurricane of change. Learn how to navigate the turbulent seas of uncertainty, ensuring not just survival but sustainable success.

This book is recommended reading for those starting out, as well as also being a serious manual for experienced corporate finance people, especially those looking to invest in sport.

To secure your Limited Edition copy now, unveil hidden risks, and sail towards a future of informed decision-making, click below 👇