Sport should ask Archimedes about Leverage!

The story of finance in the last 50 years is the story of leverage, enabling situations such as the LBO of Manchester United. This all works beautifully until interest rates start to rise...

The Albachiara Journal is an eclectic collection of our opinion and perspective, from our travels and encounters.

How many of our generation get frustrated when we try and tell our kids about past music, past cinema, past sport? Their eyes roll, and they humour us, when we talk with enthusiasm about them needing to see Citizen Kane, The Godfather, The Fabulous Baker Boys, to listen to Depeche Mode or The Specials, to appreciate the great football players that operated before the EPL and the Champions League became the only stage.

They don’t care, and we need to live with that. They do however seem to embrace fully the science and the scientists of old.

Maybe because we now live in a STEM world?

Archimedes of Syracuse was a Greek mathematician, physicist, engineer, astronomer, and inventor from the ancient city of Syracuse in Sicily. He is regarded as one of the leading scientists in classical antiquity. Considered the greatest mathematician of ancient history, and one of the greatest of all time. Archimedes anticipated modern calculus and analysis by applying the concept of the infinitely small and the method of exhaustion to derive and rigorously prove a range of geometrical theorems.

Archimedes’ other mathematical achievements include deriving an approximation of pi, defining and investigating the Archimedean spiral, and devising a system using exponentiation for expressing very large numbers. He was also one of the first to apply mathematics to physical phenomena, working on statics and hydrostatics. Archimedes’s achievements in this area include a proof of the law of the lever, the widespread use of the concept of center of gravity, and the enunciation of the law of buoyancy or Archimedes’s principle. He is also credited with designing innovative machines, such as his screw pump, compound pulleys, and defensive war machines to protect his native Syracuse from invasion.

– Wikipedia.

Astonishing! Whatever happened to the Greeks (in general) btw? They were absolutely top dogs, in empire, philosophy, sport, democracy, and discovery. Then they weren’t. Different to the Italians, who got a second wind with the Renaissance, and are still masters of style, creativity and cool. The Greeks kind of flamed out forever. They now remain as debt slaves for the Troika. That’s rough. Archimedes was Sicilian. Just saying!

Where do these utter geniuses come from?

They hardly seem of the same species as us. It’s all so magnificent, and so long ago. Archimedes‘s list above includes “a proof of the law of the lever“, On the Equilibrium of Planes.

According to Pappus of Alexandria, Archimedes‘s work on levers caused him to say: “Give me a place to stand on, and I will move the Earth“.

From the lever comes the word leverage, as in financial leverage.

The story of finance in the last 50 years is the story of leverage.

Make absolutely no mistake about that.

Leverage is a fancy term for the use of debt. The lever is debt. Its power is overwhelming and, in many ways, is the big secret in the world of finance.

Let’s show how.

The power of financial leverage.

Say I can buy any sports asset at a cost of 100 and, then, sell it in 2 years at 200, I have doubled my money, a 100% return. If however, I use leverage and buy the club, using only 20 of my own money, and 80 of external debt, and then sell for the exact same 200, I pay back my debt of 80, and have 120 left. That is now a 6 time, 500%, return on my 20 equity invested! BOOM!

Same asset, same deal, same exit. Not the same ROE!!!

Let’s take another sport’s example to labour the same point.

A club is wanting to finance a new stadium. The cost of building the new venue is £100 million. It can be funded by equity alone, or a mix of both debt and equity. Let’s add as well that the stadium generates an annual net income of £10 million.

If the project was to be fully financed by equity, it returns 10/100= 10% pa. Now let’s assume the project is half-financed from debt, and the other half being equity. The debt is never free and that is why we can assume the net income is now down to £9 million due to say £1m in interest charges. What is the impact on returns?

ROE = 9/50 = 18%.

We can clearly see here that choosing to finance half of the project with debt, improves dramatically the return for equity-holders. If the interest rate is manageable.

We could go even further and imagine a situation where 20% of the project is financed from equity, with the remaining 80% coming from debt. Again, the net income would be reduced, due to increased interest charges. So, let’s say it goes down to £6 million per year.

ROE = 6/20= 30%

Same project, same underlying profitability, three times the juice.

“Give me a lever and I will raise the world”. That is the Archimedes’s lever. It can indeed lift the world.

This is the whole story of the finance industry since Michael Milken in the 1980s, and perhaps since the creation of the Federal Reserve at Jekyll Island in 1913.

Debt and its cost. If you add in the way the banking system works, it becomes very clear. Banks don’t just lend out their depositors money. Oh no, they are far more ambitious than that. They create money/loans/debt out of thin air. It is called fractional reserve lending. Look it up.

Why do you think Henry Ford said this?

It is well enough that people of the nation do not understand our banking and monetary system for, if they did, I believe there would be a revolution before tomorrow morning.

The answer is fractional reserve lending. It all comes back to debt and the creation of it, (called credit).

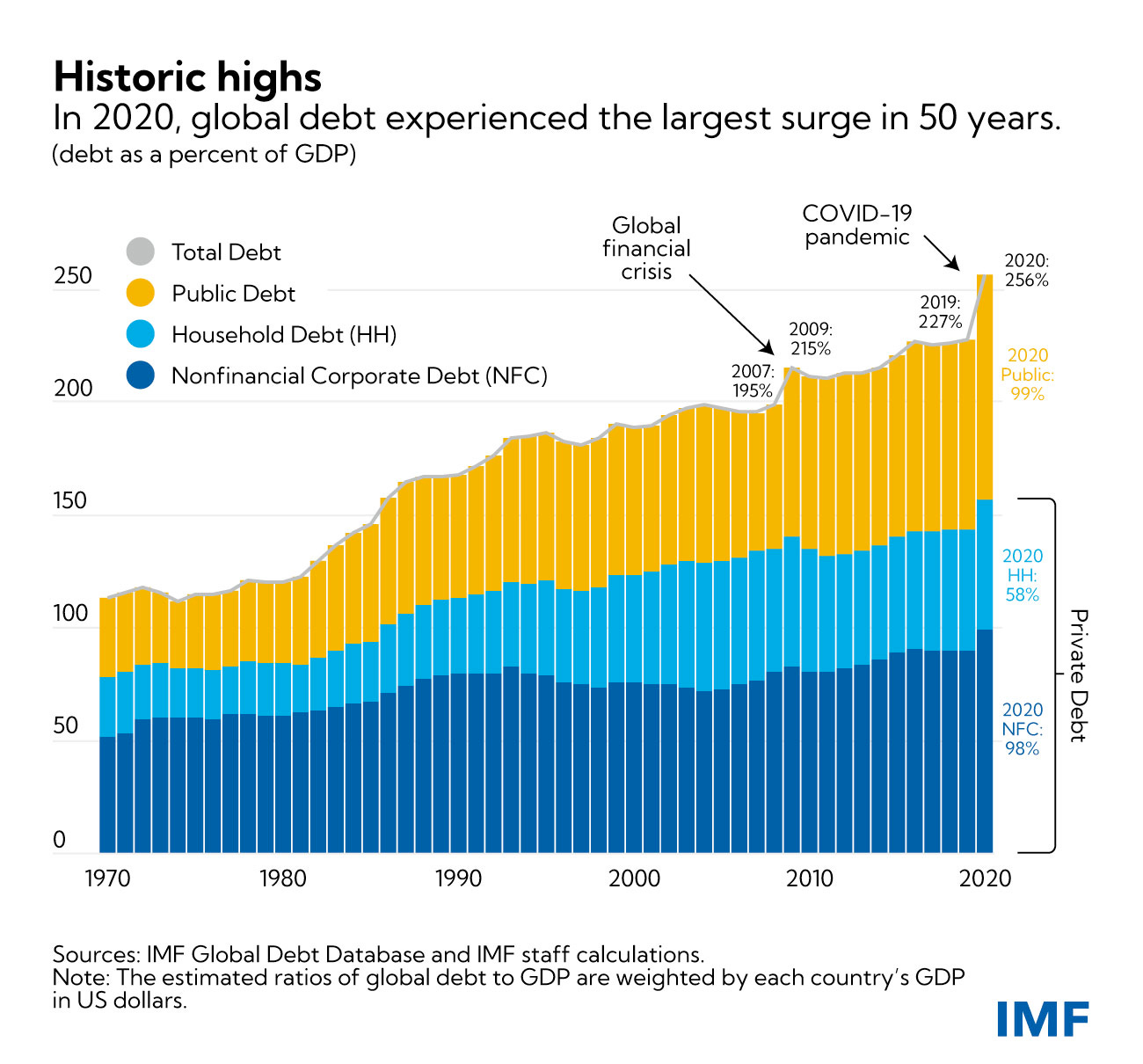

Guess what, Big Finance and governments have been using a lot more debt in the last 40 years. They like that juice.

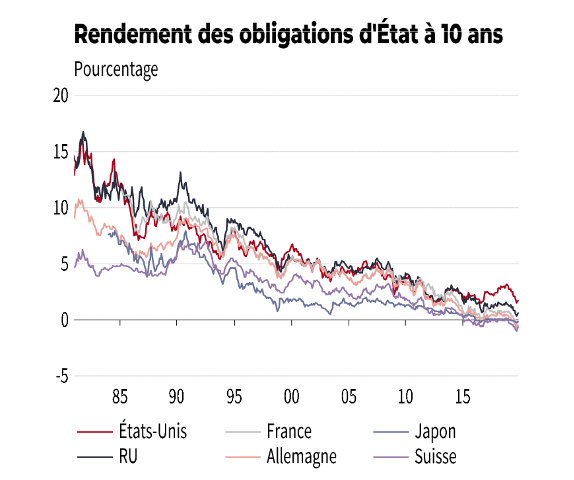

Normally the more you use debt, the more your lender wants to charge you, right? The interest rate goes up. You are a more risky borrower?

Guess again.

The cost of debt, the interest rate, has been on a consistent downtrend for 40 years. Don’t ask, it’s complicated. I’ll cover all that in my book.

However, it has all been making leverage easy, and very very cheap!!

In the sport industry, the most famous (and controversial) example of leverage is the LBO (leveraged buyout) of Man United by the Glazers.

The Glazer family bought Manchester United Football club in 2004 for £790M. To achieve that, they first created a Special Purpose Vehicle (SPV), a holding company called Red Football, which is the usual process in the case of LBOs. The SPV will raise the capital, debt and equity, required to buy the targeted firm. The Glazers brought only £250 million in equity out of the £790 million required. The rest was all debt-financed… Yes, £540 million!

That debt was secured on the assets of the club as collateral, and serviced from the cashflow of the club. Now isn’t that just a magnificent deal?

You get someone to lend you money, secured by pledging the assets you are about to buy, helpfully interest rates are also getting lower, and then you pay off the debt and interest with the cashflow of what you buy. Interest payments are tax deductible, dividends aren’t, as a bonus.

Almost as simple and genius as Archimedes.

The Glazers now own 77% of the club, which represents approximately £2.4Bn. Considering they only invested £250 million in equity in the first place, that is a very decent return.

It seems so simple and indeed, in many ways, it is. It is the way most private equity companies and investors have made their fabulous returns in the years.

Ever seen a poor private equity exec?

The 80s was the moment in time when this became the entire zeitgeist in finance. The leveraged buyout (LBO). A period called Barbarians at the Gate, from the book by two Wall Street Journal writers, Burrow and Helyar. It describes the battle for one such cash rich company, RJR Nabisco, as the rival tribes of barbarians came after a sleepy, debt free company, throwing off wads of tobacco cash. They both saw the opportunity for an LBO play. Archimedes‘s lever via debt, called junk bonds, made famous by Mike Milken. He and other investment bankers at Drexel Burnham Lambert created a new type of high-yield debt: bonds that were speculative grade from the start, and were used as a financing tool in leveraged buyouts and hostile takeovers. In a leveraged buyout (LBO), an acquirer would issue speculative grade bonds to help pay for an acquisition and then use the target’s cash flow to help pay the debt over time. Companies acquired in this manner were commonly saddled with very high debt loads, hampering their financial flexibility. Debt-to-equity ratios of at least 6 to 1 were common in such transactions.

It all works beautifully until interest rates start to rise.

In the last 12 months this has started to reverse. The risk-free interest rate has risen from zero to 5% in the US. Gulp. The cost of capital has risen DRAMATICALLY.

That means a variety of things, all of them profound.

To continue reading this article and learn about the impact of rising interest rates and what that means for valuations within sport, please click here.