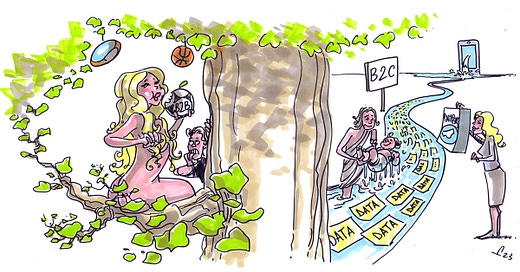

Sport’s original sin: the B2B apple

Sport has been content to be an underdeveloped B2B organisation. However, if it can become a B2C business, it could be re-rated as such, the same way tech companies are in Silicon Valley...

The Albachiara Journal is an eclectic collection of our opinion and perspective, from our travels and encounters.

… And she’ll promise you more than the garden of Eden

Then she’ll carelessly cut you and laugh while you’re bleeding

But she’ll bring out the best and the worst you can be

Blame it all on yourself, ’cause she’s always a woman to me…– Billy Joel

Amazingly, in today’s world some people give this song the misogynist label, as anti-women. I’d argue that it’s the complete opposite, and better described as a tribute to the superior machine.

You know, I have always felt that women got a very hard time on the Garden of Eden narrative. When Eve takes the apple, she takes the blame for the “original sin”. He, Adam, comes across as a bit of a simp, just watching; she instead was at least curious. Ha!

Sport suffers from its own original sin.

It is the ultimate community business, and normally when one refers to a “community business”, it almost always describes an activity with a very direct relationship with that community. Sport has the most loyal inter-generational customers/fans, and yet almost always knows next to nothing about them. Even the perennial season ticket holders are, in the main, unknown to sports clubs and franchises. Sport has thus undoubtedly taken its fans, and their loyalty, for granted. Worse than that, in every aspect of their commercial activity, outside of ticketing, they have outsourced their business, sold their community and fans, to others (broadcasters, sponsors, sporting goods manufacturers, and latterly, social media companies).

They have therefore delegated the marketing of their narrative to all these people. How can you tell a really great story, when the chapters are all told by different people? Think of the NFL these days. Games spread across days, in market, out of market, Black Friday games, Thursday, Monday. Traditional broadcasters, streamers, Amazon, Google, Nickelodeon. The monetisation is great… but the story is arguably a confused pulp fiction. Horrible for the fan who, by the way, also needs a zillion different subscriptions. No bueno. No sostenible.

Sport should be, de facto, the ultimate and purest Business To Consumer (B2C) organisation and mentality. The archetypal community B2C business. And yet, it’s not. Sport and its C-Suite instead took the snake’s apple many decades ago, in exchange for a simple life: selling off their games and events to others. Soliciting bids for a certain and safe amount of money up front; a rights bid, a minimum guarantee license, a sponsorship fee. Once received, they required and wanted very little to do with their fans, and consequently have never known anything about them.

Sport has been content to be an underdeveloped Business to Business (B2B) organisation.

It acted like this, to be fair, through little fault of its own. For so many of its participants, it has never even seen itself as a business at all. It was staffed by rules and regs (regulations) guys, paperwork clerks: all pawns in the empire-building of an all-powerful manager like a Lombardi, Shankly, Busby, Ferguson or Clough. Whilst other consumer FMCG industries, from the 1950s onwards, got into the theory and practice of world class strategic marketing, to win market share, sport looked for a “secretary” who could read the FA rulebook. No-one really cared, also because the small monies generated by sport didn’t make it worth the candle. That phrase: Everton FC makes less money that the local supermarket in Goodison.

Maximising B2B money up front is Sport’s Original Sin.

Giles Morgan has made this, and his rich fan data Road to Damascus epiphany, his schtick in recent years. Many sniggered, but he was right. Darwin would have liked Mr Morgan. Adaptability.

Here is the gospel truth. My version of Eden’s wrath “You will crawl on your belly and you will eat dust all the days of your life”.

Whilst sport has thrived handsomely on the back of cheap money and myriad platforms bidding “long” for their rights; for the blazers, knowing their fans wasn’t important. Sport, through its laziness and hubris has thus pored its finest champagne into the ocean, allowing others to build tremendous businesses on-top. The newspapers, the media companies, the social media companies, shoe manufacturers, etc. In their dash for the minimum guarantee, the nice safe money up front, they have left too much to others.

For sport, a bird in the hand has NOT been worth two in the bush.

It has in reality has been a mug’s game.

So, now, as capital becomes scarce and expensive, the monetisation of the brand and fan loyalty is the last life raft. The only out-shot for an industry. B2C is now essential thinking for sport.

In recent decades, especially with the arrival of the internet and the impact of venture capital (VC) thinking, the equity “value” in business and investing has been given to those who DID know their clients. Who DID have a direct relationship. Sport, from that point of view, is now playing catch up and is very exposed. It has little time to sort this out, “crack the code” as Elliot Richardson calls it.

The untapped future for sports is monetizing the lifetime value of their customers, beyond selling tickets and merchandise and maybe a subscription to Sunday Ticket.

– George Pyne (Founder Bruin Capital)

So much of what is going to happen now in sport is around the gear-crunching change from B2B to B2C. For many a problem, for some, like Elliot, an opportunity.

Last week’s Sunday Column wound forward a bearish case for the valuations of sport in a world of rising cost of capital and unwinding leverage. Sorry folks, I apologise; no-one likes a killjoy.

So, for balance, here is Elliot’s bull case. Sport’s Baptism water to cleanse the B2B original sin.

If sport can be considered as a B2C business, it would be re-rated as such, the same way Tech companies are in Silicon Valley: per user!

(Sure, I hear the screams of people saying that the Valley playbook of such valuations is already deflating as we speak, and that may be true, but the principle remains.)

Some call it Unit Economics. I prefer to call it…

… the golden formula for modern business:

LTV > CAC

CAC= the average cost of acquiring a new customer

LTV= the total expected revenue that a business will receive from one customer (ARPU) over the course of his/her use of your product/service

So many businesses now work like this. Think betting, the perfect example. All this digital marketing, all these skills, are not about awareness. They are about getting people into your customer funnel, to ultimately convert them into enduring paying clients.

The better you do that (by smart spending, by efficient conversion techniques), the lower your CAC is. Sport has a huge advantage. The fans are already there and they ain’t churning. CAC should be very low.

And here comes the other side. The George Pyne ARPU (average revenue per user) LTV side. Get your fans/customers to spend more with you, capture more of their budget. Their travel, their Christmas gifts, their kit. Sell them more branded goods, offer them more real utility from a serious loyalty program. Use your club content directly with them for value. Get then to spend the whole day at your stadium.

To start doing all of this well, you need the very best fan data. Rich and detailed data. I always love the example of knowing if your fan is married and since when. Pampers would love to know the names of your fans who got married in the last year, coz the stats say that the stork is arriving soon. You get it? Rich data is the gold. Albachiara has been teaching this course for 5 years now. This Pampers example always is a jaw-dropper, and in 2023, it shouldn’t be.

So this Unit Economics theory raises a very crucial point for sport:

on a per user basis, should clubs be valued much higher?

Like this: Number of Users x (Customer Lifetime Value (LTV) – Customer acquisition Cost (CAC))

– Real Madrid has 340m followers on social media and had a value of $3.9bn in 2020 (source KPMG: the European elite)

– As a comparison, Twitter has 436m active users and Musk paid $44bn to acquire the platform.

Think about that fact, would you?

Twitter only has 28% more users/followers than Real Madrid, but its value is 10 times (900%) higher.

To labour the point, TikTok has 2 billion users, double the 1 billion Man United fans. Its valuation is not double, it is 100 times higher!

This right here is the value in “cracking the code” in sports valuations.

And step 1 is blowing away the bullshit vanity metrics still on all those sponsorship decks. Folks, you are kidding no-one. Saying you have millions of fans is not enough, you must be able to monetize that fanbase. Barcelona FC realized that brutally, when Spotify decided to lower the value of the sponsorship deal. They simply discovered that only 1% of the 350M alleged fans were registered with the club.

Whilst you’re at finding out about your fans, realise that they are not homogenous. They now need skilled segmentation.

Yes, kids are different, and NOT transient.

They won’t grow out of it.

Gen Z is being lost.

You have to make them a fan by the time they’re 18, or you’ll lose them forever.

– Tim Ellis, Chief Marketing Officer, NFL

In the face of this upside, why can’t sport just flip to B2C overnight?

In my direct experience, here are the reasons, none of which will come out of an MBA analyst studying the Private equity (PE) model.

…

To continue reading this article and learn about those reasons why sport can’t flip to B2C overnight and how Albachiara look at all this as an investor, please click here.